In today’s competitive e-commerce landscape, effectively managing your Klarna integration and merchant account is crucial for Shopify dropshipping success. However, merchants often make preventable mistakes that can impact their business performance. Let’s explore the ten most common pitfalls – five from the storefront perspective and five from the merchant account management side – and learn how to avoid them.

In today’s competitive e-commerce landscape, effectively managing your Klarna integration and merchant account is crucial for Shopify dropshipping success. However, merchants often make preventable mistakes that can impact their business performance. Let’s explore the ten most common pitfalls – five from the storefront perspective and five from the merchant account management side – and learn how to avoid them.

Storefront Integration Mistakes

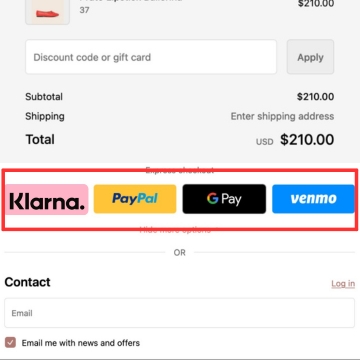

1. Insufficient Payment Method Communication

A fundamental error many dropshipping merchants make is inadequately communicating Klarna as a payment option throughout the customer journey. Simply displaying Klarna at checkout isn’t enough in today’s competitive e-commerce environment. This minimal approach significantly reduces the potential impact of offering buy now, pay later (BNPL) options.

To maximize conversion rates, implement Klarna messaging strategically across your entire store. Place Klarna widgets on product pages, showcase payment options on your homepage, and integrate clear messaging in your shopping cart. Utilize Klarna’s official marketing materials and price-slice messaging to build trust and increase average order value (AOV).

2. Improper Product Category Configuration

Misclassifying products in your Klarna settings can lead to unnecessary payment declines and account complications. Each product category has specific requirements and risk assessments associated with it, making accurate classification crucial for smooth operations.

Create a systematic approach to product categorization:

- Regularly audit your product catalog against Klarna’s category guidelines

- Pay special attention to high-risk categories like electronics and supplements

- Document your categorization process for consistency across new product additions

- Set up automated checks for category alignment when adding new products

3.Ignoring Mobile Optimization

With mobile commerce accounting for over 70% of online shopping traffic, poor mobile optimization of your Klarna integration can severely impact your conversion rates. Many merchants focus on desktop experiences while neglecting mobile users.

Implement a comprehensive mobile optimization strategy:

- Test Klarna widgets and checkout flows across multiple mobile devices

- Optimize button placement and form fields for touch interfaces

- Ensure fast loading times for payment-related elements

- Regular testing of the mobile checkout process across different scenarios

4. Poor Order Fulfillment Integration

Misalignment between Klarna payments and order fulfillment processes can create a nightmare for customer service and lead to payment disputes. This disconnect often results in delayed shipping updates and confused customers.

Develop a robust order management system that:

- Automatically syncs order status between Klarna and suppliers

- Provides real-time tracking information updates

- Includes automated communication triggers for order status changes

- Maintains clear documentation of fulfillment timeline

5. Inadequate Customer Support Preparation

Unprepared customer support teams can struggle with Klarna-related inquiries, leading to customer frustration and potential lost sales. Many merchants underestimate the complexity of BNPL-related customer questions.

Merchant Account Management Mistakes

6. Insufficient Risk Management

Many merchants fail to implement proper risk management strategies for their Klarna merchant account. This oversight can lead to increased fraud rates and potential account restrictions.

Implement robust risk management practices:

- Set up fraud detection tools and monitoring systems

- Regularly review transaction patterns for suspicious activity

- Maintain detailed documentation of high-risk transactions

- Establish clear protocols for handling suspected fraud cases

7. Poor Financial Record Keeping

Inadequate financial record keeping can create serious problems with Klarna account reconciliation and overall business management. Many merchants struggle with properly tracking Klarna payments against orders.

Establish strong financial management practices:

- Implement automated reconciliation systems

- Maintain detailed records of all Klarna transactions

- Regularly audit payment records against bank statements

- Create clear protocols for handling payment discrepancies

8. Neglecting Account Health Metrics

Failing to monitor key account health metrics can lead to unexpected account restrictions or increased fees. Many merchants only check their Klarna dashboard when problems arise.

Monitor these crucial metrics regularly:

- Payment acceptance rates

- Chargeback ratios

- Customer dispute rates

- Average order processing times

- Settlement timeframes

9. Improper Returns and Refund Management

Mishandling returns and refunds can negatively impact your Klarna merchant account standing and create unnecessary customer service issues. Many merchants lack clear protocols for processing Klarna-specific returns.

Develop comprehensive return management procedures:

- Create clear return authorization processes

- Establish automated refund tracking systems

- Maintain detailed documentation of all return cases

- Regular training for staff handling returns

10. Overlooking Terms and Conditions Updates

Failing to stay current with Klarna’s merchant terms and conditions can lead to compliance issues and potential account restrictions. Many merchants miss important policy updates that affect their operations

Best Practices for Success

To optimize both your storefront integration and merchant account management:

- Conduct regular audits of your Klarna integration and account settings

- Implement automated monitoring systems for key metrics

- Maintain detailed documentation of all processes and procedures

- Provide regular training for staff handling Klarna-related tasks

- Stay informed about Klarna policy updates and new features

Proactive Management Strategies

To ensure long-term success with Klarna:

- Schedule monthly reviews of account performance metrics

- Create a dedicated team for Klarna account management

- Develop relationships with Klarna support representatives

- Regularly update your integration and security measures

By avoiding these ten common mistakes and implementing proper management strategies, you can create a more efficient and profitable Klarna integration for your Shopify dropshipping business. Remember that successful Klarna management requires attention to both customer-facing elements and backend operations.

Take time to regularly assess your Klarna implementation against these points, making necessary adjustments to optimize performance. The investment in proper Klarna management will result in increased sales,